Car insurance, such as other forms associated with insurance coverage, is actually bought to safeguard towards reduction. Losing might be for your personal automobile or even the home owned by another person. Along with home, there might be healthcare costs or even losing earnings. Just about all says established the actual kinds of insurance coverage as well as minimal protection quantities which motorists should have to be able to run or even sign-up an automobile. Other forms associated with auto insurance might be needed through loan companies that financial an automobile.

From minimal, condition laws and regulations will need that you simply have legal responsibility insurance coverage. This particular includes 3 types of protection and it is usually mentioned because a number of 3 amounts. The very first quantity may be the optimum the actual insurance provider can pay with regard to accidental injuries experienced through anyone within an incident a person trigger. The 2nd quantity may be the optimum taken care of accidental injuries in order to several individuals hurt within the exact same incident. The 3rd quantity signifies the most that’ll be taken care of home harm. Legal responsibility doesn’t include your own accidental injuries or even the actual harm to your vehicle. This just handles deficits experienced through other people within an incident that you are in problem.

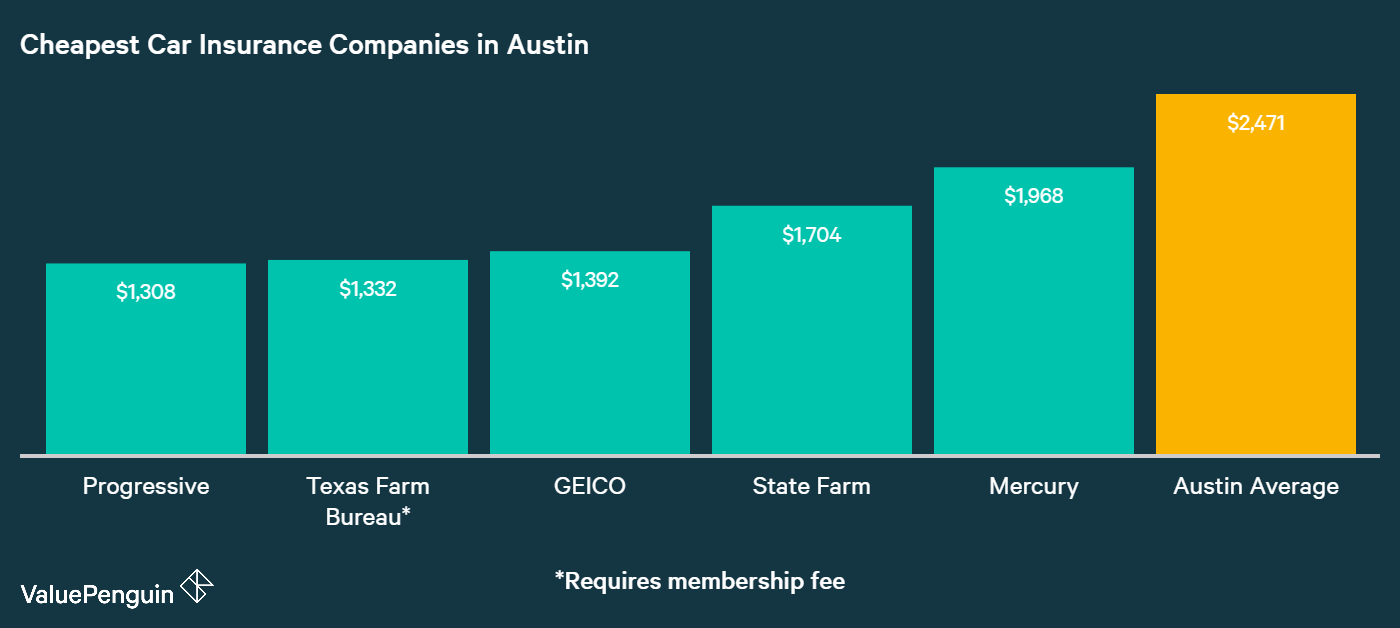

You should acquire a number of car insurance estimates before you decide to pick a plan. Prices differ in between businesses, dependent mainly on the previous background associated with deficits. You should make sure that a person evaluate similar functions, such as insurance deductible quantities as well as legal responsibility limitations. You might want to get yourself a auto insurance quotation in the organization along with who you’ve your own homeowners’ plan. You are able to occasionally cut costs through “bundling” your own insurance plans, however this isn’t usually the situation.